Right

Valuation

Right

Decision

Sell and Acquire Business as Easily as Picking

Groceries

100+ Businesses Helped So Far

For Buyers

Find your ideal business! Explore our premium listings or let us help you acquire the business you have in mind.

For Investors

Expand your investment portfolio. Discover lucrative Business opportunities and make informed decisions to boost your returns.

For Sellers

Unlock the value of your Business. List with us to connect with motivated buyers and maximize your return

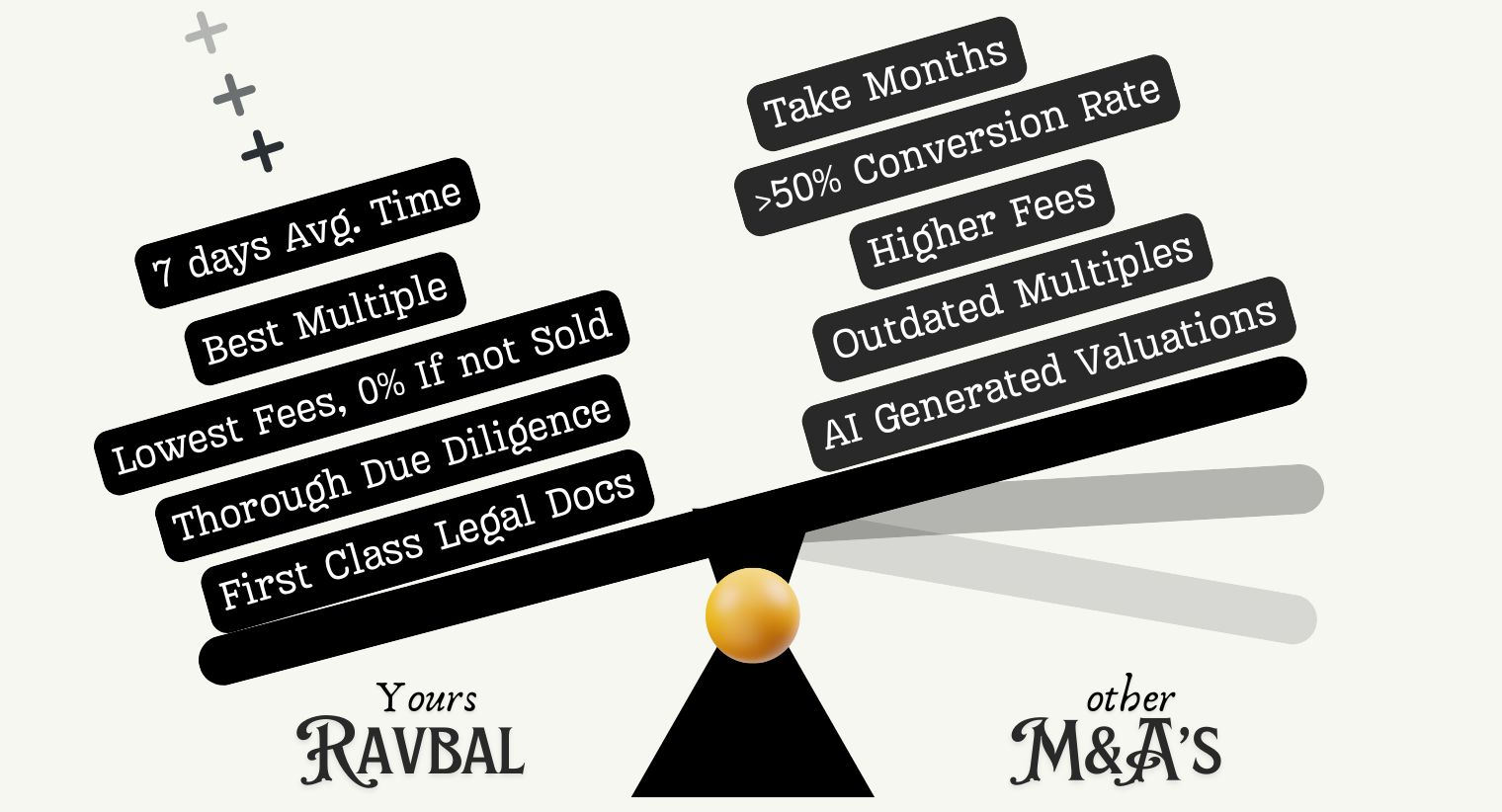

WHY US?

With RavBal, Businesses are typically sold and Acquired in an average of 7 days, thanks to our efficient and targeted approach.

Zero Fees If Business is Not Sold or Acquired

Top-Tier Legal Documentation

Comprehensive Due Diligence (Guaranteed)

Swift Site Transfer

60 Days Post Sale Support

Enhanced Security & Confidentiality

Round-the-Clock Support 24/7

Fare Inspection Period

Our Portfolio is Featured On

FAQ’s

Your Queries, Answered

What About Legal Complexities

We take legal complexities seriously, treating them with the same importance as life and death situations. From drafting to finalizing, we handle every legal document with meticulous care, ensuring full compliance and protection. You won’t have to lift a finger—we manage everything from start to finish

What is due diligence take, and why is it important?

Due diligence is a critical step in the M&A process, allowing us to evaluate a business’s financials, operations, and legal standings thoroughly.

How long does due diligence take?

This phase is often the lengthiest, taking anywhere from 10 to 15 days. At RavBal, our due diligence process is unparalleled. We take care of every minute detail, considering all factors to ensure a comprehensive evaluation. This meticulous approach helps in informed decision-making and risk mitigation for both buyers and sellers.

What happens if my business doesn’t sell?

It’s rare for a business not to sell through RavBal, as we are dedicated to ensuring successful transactions. In the unlikely event that your business doesn’t sell, we stand by our commitment to you with a zero-fee guarantee. You won’t incur any costs for our services until we achieve a successful sale. Your success is our priority, and we only get paid when you do.

How does RavBal ensure confidentiality during the M&A process?

Confidentiality is paramount at RavBal. We implement stringent protocols to protect your business information throughout the M&A process. Our team uses secure communication channels, signs non-disclosure agreements (NDAs), and limits access to sensitive data to only those directly involved. We take every measure to ensure your business remains confidential, safeguarding your interests at every stage of the transaction.

How does RavBal differentiate itself from other M&A advisory firms?

RavBal differentiates itself through our relentless focus on efficiency, comprehensive end-to-end support, and a client-first approach. We deliver results swiftly, backed by our zero-fee guarantee if your business doesn’t sell. Our personalized strategies and deep industry expertise ensure we prioritize your success at every stage, making us a trusted partner in the M&A process

Have More Questions?

If you still have questions or need more information, don’t hesitate to reach out. We’re ready to assist you every step of the way.

Ask Us Anything!99% Satisfactory Rate

RavBal handled everything seamlessly, from the agreement to the transfer. I could relax and let them do the work. Highly recommended!

Rody J

Seller